We expect major upheavals in the financial markets over the next few years. In this article we explain our cyclical framework for these challenging times and why you should invest in commodities now.

Published: 16th of June, 2021

Energy Revolution – Part 10

Utility-Scale Battery Storage for more Energy System Flexibility

30th of November, 2021 - torck capital management AG

In our last blog article, we discussed the use of batteries for consumer market products and how battery technology innovation has set the path for a widespread adoption of electric vehicles (EVs). While batteries were first developed for the use in consumer electronics, the demand for EV batteries now makes up 85% of total battery metal demand and, according to the IEA, could grow by nearly 30 times between 2020 and 2040. Stationary energy storage systems represent only a small part of overall battery demand at the moment. But prospects for utility-scale battery storage look set to improve as advances in technological innovation emerge (see Figure 1).

Historically, trends from the automotive industry, according to the IEA, have often transferred to the power sector. During the past decade, the price of lithium-ion batteries – the key technology for electrifying transport – has already declined by nearly 90% to around $110 per kW/h, according to consultancy Benchmark Mineral Intelligence, while their energy density has risen about 4% a year over the past two decades. As the price and energy density of Li-ion batteries further improve with the widespread adoption of EVs, the next step, and what will define the next decade, is utility-scale storage.

While still in its infancy, battery storage at the grid level is set to play a key part in the future of the renewable energy industry as an alternative energy storage system. Decarbonisation of the power generation fuel mix coupled with the electrification of the transport sector makes a central contribution to achieving net-zero emissions. The share of electricity wind and solar PV, due to their low cost, widespread availability, and policy support is expected by the IEA to rise from under 10% in 2020 to nearly 30% in 2030, which represents a tripling in their capacity. Their inherently intermittent nature necessitates the deployment of energy storage solutions, which effectively integrate with renewable energy, unlock the benefits of local generation, and enable a clean, resilient energy supply. The requirement for grids to maintain a constant flow of electricity has made energy storage systems an integral in the different segments of the electricity supply chain, from generation, to transmission and distribution, to consumption. This creates a lot of new opportunities for technology innovation. Tesla CEO, Elon Musk, said that he expects the company’s energy business – including the supply of solar and huge lithium-ion batteries for the grid – to be as big as its car business in the long term.

Market applications of battery energy storage are commonly differentiated as: front-of-the-meter (FTM) or behind-the-meter (BTM). FTM batteries are utility-scale storage systems that are connected to distribution or transmission networks or to a generation asset. BTM batteries are interconnected behind the utility meter of commercial, industrial or residential customers, primarily aiming at electricity bill savings through demand-side management.

Our focus is on utility-scale battery storage. Unlike conventional storage systems, such as pumped hydro storage, which accounts for over 90% of the world’s energy storage, utility-scale batteries have the advantage of geographical and sizing flexibility. Their storage capacity typically ranges from around a few megawatt-hours (MWh) to hundreds of MWh. Different battery storage technologies, which prioritise cost, durability and safety over size and weight, such as Li-ion, sodium sulphur and lead acid batteries, can be used for grid applications. However, in recent years, the technology mix has remained largely unchanged, whereby Li-ion batteries continue to be the most widely used.

With the rising importance of electric mobility on the demand side, and of variable renewable energy sources, which are dependent on weather conditions, on the supply side, balancing grid volatility and when and where electricity is needed has become a key challenge. What makes utility-scale battery storage systems unique is their capability to quickly absorb, hold and then reinject electricity. They can respond to system operator’s instructions in milliseconds and generally provide up to four hours of storage. Coupling renewable energy generation sources with a battery both reduces the variability of the power output at the point of grid interconnection, thus facilitating better integration of renewables, and creates a capacity reserve that can be discharged during peak hours. The key services offered by utility-scale batteries are summarised in Figure 2 and can be further read up on in IRENA’s utility-scale batteries innovation landscape brief.

However, to fully replace fossil-fuelled power plants and peak-plants that are only used at times of peak demand, cheaper, longer-duration storage technologies – most of which are not yet cost-effective – are needed along with Li-ion batteries. Vanadium flow batteries (VFBs) are one such technology that could emerge as an alternative stationary storage. VFBs are capable of being sized according to energy storage needs with limited investment and have the advantage of very long lifetimes. With eight to ten hours of energy storage, VFBs can be charged during the day and deploy their energy during peak demand, or overnight, helping to put a floor under power prices. The IEA assumes that VFBs first become commercially suitable in 2030 with a small share, growing modestly to capture a wider market for storage applications in large renewables projects. Despite their advantages, it may be challenging for VFBs to reach the same manufacturing scale as Li-ion, which has been driven by the surge of investment in electric cars over the past decade.

Overall, upfront investment costs are still a barrier to the growth of the utility-scale battery storage market despite significant reductions in recent years. Therefore, storage remains heavily dependent on policy support. To make up for the economic viability gap of electricity storage projects governments could provide incentives that are similar to those used to support the deployment of renewables in their early stages of development. These incentives include capacity payment, grants, feed-in-tariffs, peak reduction incentives, investment tax credits or accelerated depreciation.

As the prospects for battery storage systems are expected to improve with more effective regulation that adequately reflects the value of the flexibility services they provide, the IEA expects utility-scale battery storage additions to continue its exponential growth path. After annual installations of battery storage technologies fell for the first time in nearly a decade in 2019, largely due to uncertainty and slow progress in establishing rules and regulations for its deployment and use, they rebounded by over 60% in 2020.

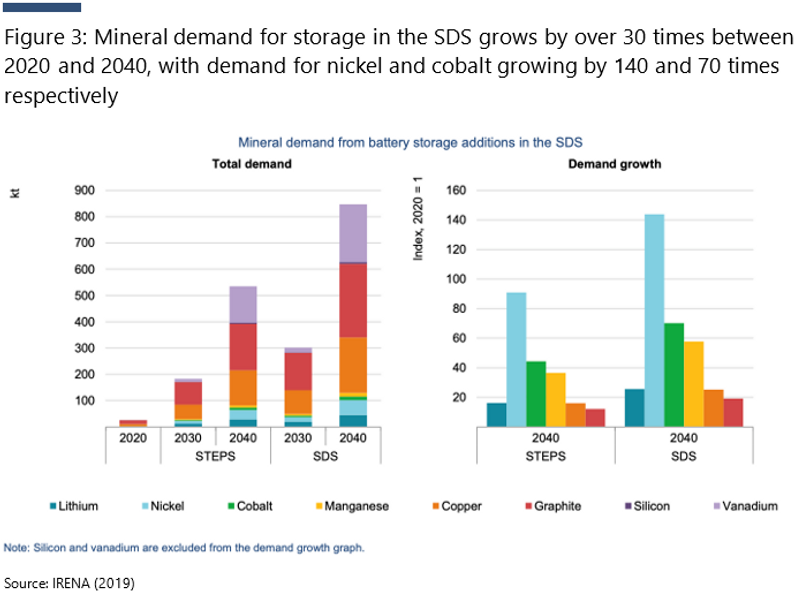

In the IEA’s Sustainability Development Scenario, global installation of utility-scale battery storage is projected to increase 25-fold between 2020 and 2040. The largest markets for battery deployment in 2040 are India, the United States and China. Demand for minerals is expected to even outpace battery demand growth due to the use of more mineral-intensive nickel-manganese-cobalt chemistries – the technology of choice in EVs – which already account for around 60% of utility-scale batteries. This is a demonstration of spillover effects from the transport to the energy sector, mentioned in the beginning of the article. Mineral demand for storage in the SDS could, therefore, grow by over 30 times between 2020 and 2040, whereby demand for nickel and cobalt is respectively growing by 140 and 70 times (see Figure 3).

About torck capital management

torck capital management is an asset management boutique based in Zurich. Well-established in the Swiss financial industry, our goal is for torck to become the leading boutique of choice for exponential opportunity investments. We aspire to both drive meaningful change with our investments and seize exponential return opportunities in times of market disruption. Our new “Energy Revolution Fund” – launched at the end of September 2021 – builds on the thesis that a worldwide clean energy transition will kick-start another “super cycle” of rising commodity prices, which was last seen in the early 2000s when China’s economic growth took off. With investments in hand-picked junior mining companies that ensure an adequate supply of minerals for the clean energy transition, we see the potential for our next exponential opportunity.

Follow our upcoming blog articles to learn more about how the clean energy transition will impact the demand for critical minerals and create a strong investment case for junior mining companies.